New

Loan Advisor AI

Smarter Loans, Powered by AI

Loanly helps you find the right loan, at the right rate, with AI-powered recommendations tailored to your financial situation. Say goodbye to guesswork, hidden fees, and outdated credit checks.

- Instant processing time (<5 min)

All your lending needs in a single platform.

Connect Your Financial Profile. Securely link your bank account or enter your income and expenses

Personal Loans

AI Evaluates Your Options. Our intelligent engine analyzes your cash flow, credit history, and spending habits.

Business Loan

Receive Personalized Loan Recommendations, Compare rates, repayment plans, and lenders instantly

Mortgage

Get Approved Faster. Apply confidently, knowing your AI advisor has guided you to the best option.

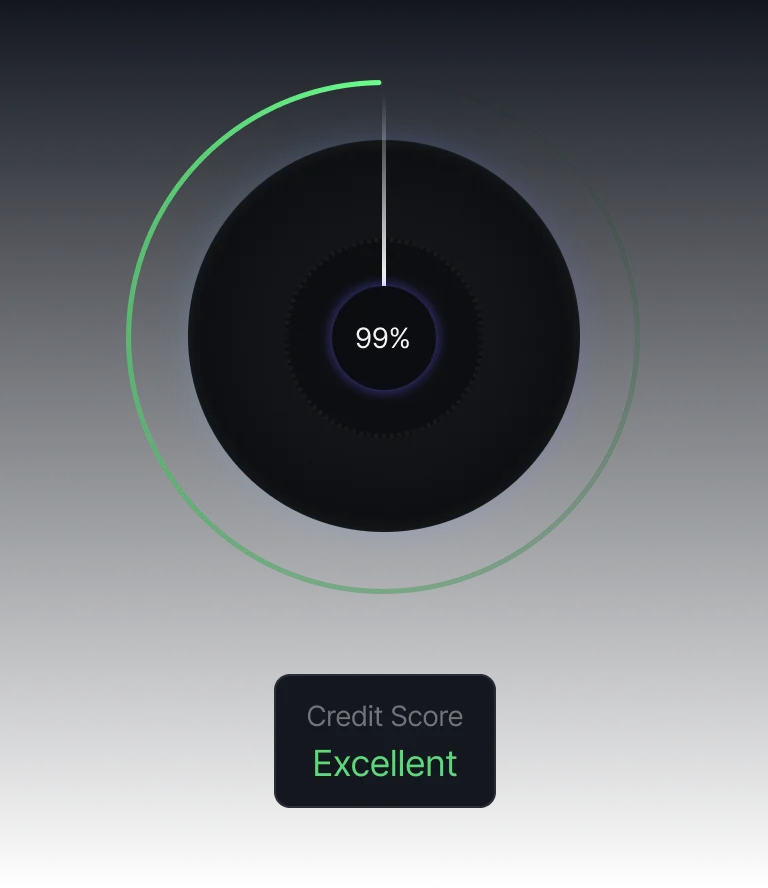

Your credit score gives us a snapshot of your past borrowing behavior, helping our AI understand your financial reliability. Loanly doesn’t rely solely on traditional scores instead, we combine your credit history with cash flow patterns and repayment behavior to assess eligibility fairly. Even if your score is lower or limited, our AI can identify opportunities for you to access loans responsibly.

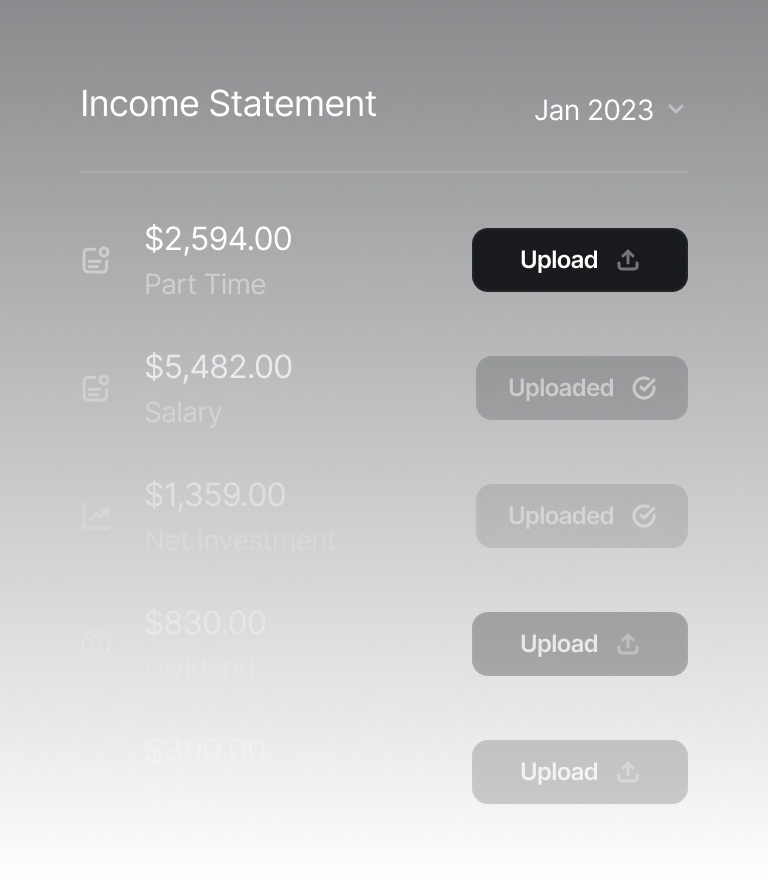

Your income determines how much you can safely borrow and repay without stress. Loanly’s AI analyzes your earnings, cash flow, and financial obligations to recommend loans that suit your budget. We prioritize responsible lending, so you’ll see options that match your actual ability to pay back, helping you avoid overborrowing and late payment fees.

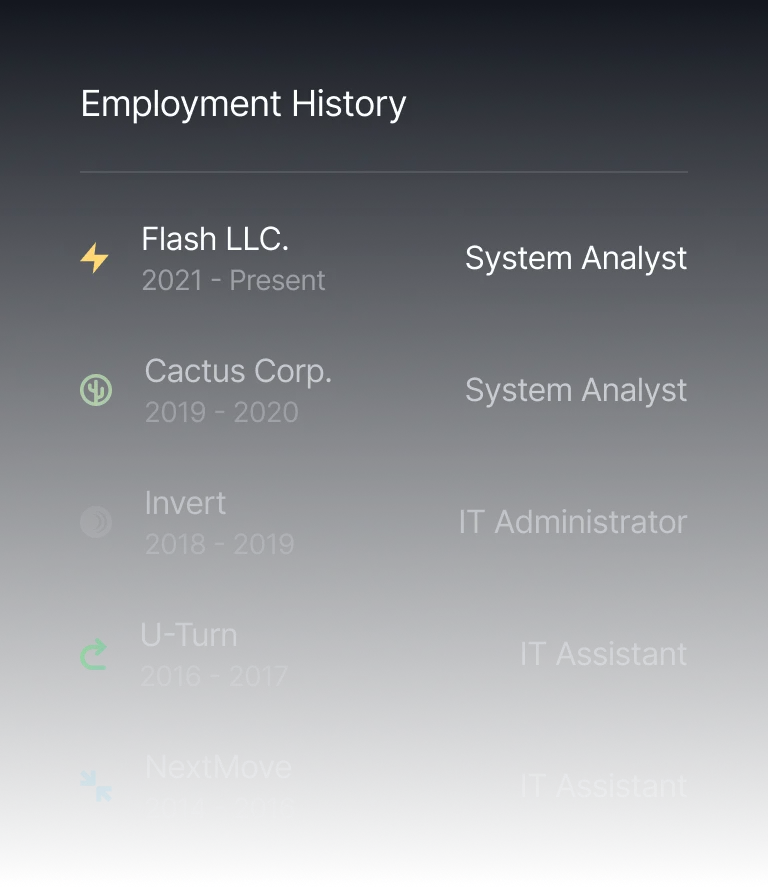

Loanly considers your work background to gauge stability and repayment capacity. Whether you’re a full-time employee, freelancer, part-time worker, or gig economy professional, our AI evaluates the consistency and reliability of your income over time. This ensures that borrowers with non-traditional employment paths are treated fairly and can access the right loan options.

Peer-to-peer lending rate and fees.

Loanly Is For Everyone Who Needs Smarter Borrowing

What they say about us.

@jenny · May 15

Loanly helped me find a loan I could actually afford as a freelancer. The AI recommendation made the process so easy

@phoenix · May 15

I didn’t know my student loan options could be so clear. Loanly showed me exactly what I could afford

@drew · May 15

As a small business owner, Loanly’s repayment simulations saved me from taking a risky loan. I feel more in control now

@baker · May 15

Loanly’s AI recommendations made my first personal loan so much easier. I understood exactly what I was borrowing and how to repay it.

@jenny · May 15

As a freelancer, banks usually reject me. Loanly analyzed my cash flow and showed me loan options I could actually afford. Game-changer!

@candice · May 15

I never realized how different repayment plans could impact my finances. Loanly’s simulation tool helped me pick the best option for my budget.

@wu · May 15

Loanly helped me compare small business loans quickly. I found the best rate without spending weeks on research.

@zahir · May 15

I’ve always struggled to build credit as a newcomer. Loanly guided me with personalized advice and helped me qualify for a responsible loan.